Market Update - November 2023

Welcome to the November edition of the Market Update

The Month in Review is our monthly report providing economic commentary with Australian and global economic summaries, alongside market news for each key asset class.

Market Key Points

-

The Australian market continued its decline in October finishing the month lower by 8% with heavy falls in Information Technology, Health Care and Industrials, Utilities the only sector in the black.

-

Overseas markets also declined, with falls across both developed and emerging markets.

Australian Equities

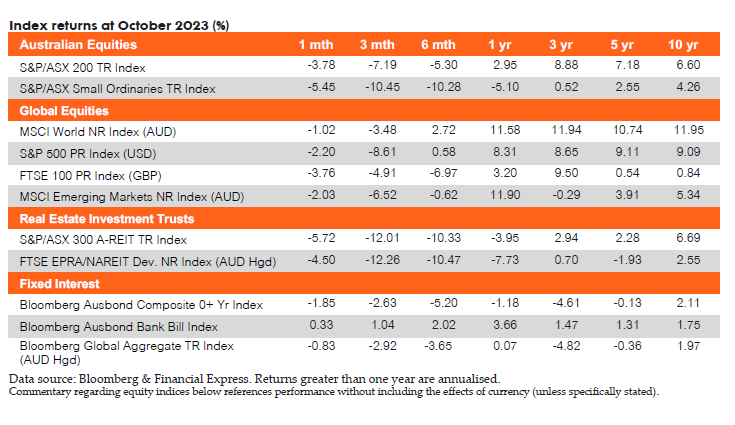

October saw the ASX 200 finish down 3.8%, marking the third consecutive month of negative returns. 10 of the 11 sectors finished in the red, with Utilities finishing October as the only gainer (1.7%), while Information Technology (IT) (-7.6%), Health Care (-7.2%), Industrials (-6.4%), and Real Estate (-6.1%) saw losses. Several factors have contributed to the drag on returns, including stubborn inflation, rising bond yields, tentative company earnings outlooks and ongoing geo- political tension.

Utilities benefitted as investors moved to defensives, while IT was hit particularly hard by rising government bond yields. Megaport, a constituent of the IT sector, was a significant drag, as its quarterly customer growth report concerned investors. Expectations for a November RBA rate rise were high following accelerating retail spending data and a stickier-than- expected inflation report. This sentiment of rising interest rates was echoed in the yield-sensitive Real Estate sector as it saw a significant downturn.

In all, the ASX 200 retreated in October, indicative of the significant headwinds that the local market continues to face.

Global Equities

Global equities had another negative month across the board, developed markets outperformed emerging markets counterparts returning -1.0% (MSCI World Ex- Australia Index (AUD)) versus a -2.0% return according to the MSCI Emerging Markets Index (AUD).

Investor concerns continue around interest rates remaining higher for longer. US equities declined

following the Federal Reserve’s stance of a “restrictive” policy until inflation seems to ease. This saw the S&P500 Index decline by -2.1% (in local currency terms) during the month. The same concerns were raised in the UK, also holding interest rates at 15-year historical highs.

The FTSE 100 Index returned a loss of -3.7% (in local currency terms) for the month.

Equities across Asia were also predominantly negative. China’s economic growth recovery plans have seen relative slowdown, with headwinds in the real estate sector and investor pessimism around the levels of Government involvement. This was reflected by the CSI 300 Index, returning -3.1% (in local currency terms) for the month.

Property

Local and Global REITs continued to sell off during October. Domestically the A-REIT index (represented by the S&P/ASX 200 A-REIT Accumulation Index) ended the month –5.8% lower. Global REITS (represented by the FTSE EPRA/NAREIT Developed Ex Australia Index (AUD Hedged)) slightly outperformed the local REIT index, albeit still experiencing a significant drawdown of –4.4% during the month. Australian infrastructure finished lower through October, with the S&P/ASX Infrastructure Index TR returning –3.1% for the month.

October saw some activity on the M&A front across the A-REIT sector. Mirvac (ASX: MGR) entered an agreement to acquire land lease operator Serenitas for

$643mn. The acquisition expands Mirvac’s residential offering and makes them one of the largest owners in the lad lease community sector. Centuria Industrial REIT (ASX: CIP) announced the divestment of two assets for a combined value of $70 during the first quarter of FY24. Dexus (ASX: DXS) announced that long standing CEO Darren Steinberg will step down after 11 years in the role in 2024. Dexus are yet to announce a replacement.

The Australian residential property market experienced a +0.9% change month on month represented by Core

Logic’s five capital city aggregate. Perth (+1.6%), Brisbane (+1.4%) and Adelaide (+1.3%) were the best performers. Notably, all five cities experienced positive change month on month through October.

Fixed Income

Michele Bullock has kept the cash rate at 4.10% in her first meeting as Governor of the RBA. The month saw bond yields rise, with Australian 10- and 2- Year Government Bond yield rising by 44bps and 37bps respectively. Unsurprisingly the Bloomberg AusBond Composite 0+ Yr Index returned -1.85% and the Bloomberg AusBond Credit 0+ Year Index AUD returned –0.77% over the month. The Australian economy has remained strong and has meant inflation has been slower to fall. Another rate hike is priced in for the RBA’s November Cup Day meeting.

Economic Key Points

-

RBA maintained the cash rate at 1% but higher than expected inflation and retail sales in September points to a rate rise in November.

-

US GDP for 3Q23 was 9%, contrasting with the Eurozone’s -0.1% for the same period.

-

Eurozone inflation unexpectedly dropped to 9%, with the US steady at 3.7%. The UK remains the outlier with a stubbornly high rate of 6.7%.

Australia

The RBA held the cash rate at 4.1% in October but higher than expected inflation and retail spending data in September increases the likelihood of a rise in November. Inflation for the September quarter rose to 1.2%, with annual rate registering 5.4%, down from 6.0% in the previous quarter. The most significant price rise for the quarter was 7.2% in automotive fuel, the biggest rise since March 2022, which included the start of the war in Ukraine.

Westpac-Melbourne Institute Index of Consumer Sentiment rose to 82 in October, but optimism remains in short supply in the face of persistently high inflation and renewed rate rise concerns. The unemployment rate fell to 3.6% in September, slightly below market expectations. Retail sales increased by 0.9% in September, largely due to a warmer than usual start to Spring, while annual sales rose 2.0%.

Composite PMI fell to 47.6 in October, driven by a solid decline in private sector activity. The NAB business confidence index also fell to 1 in September, well below the average.

The trade surplus came in at a 30 month low of $6.79 billion in September, well below market forecasts of $9.4 billion.

Global

In its World Economic Outlook, the IMF revised down its forecast for global growth in 2024 to 2.9%, with the 2023 figure remaining at 3.0% - both below the 3.8% historical average. Advanced economies are expected to have growth rates of 1.5% in 2023 and 1.4% in 2024, amid stronger-than-expected US momentum but weaker-than- expected growth in the euro area. Emerging market and developing economies are projected to grow 4.0% in both 2023 and 2024, with a downward revision of 0.1% in 2024, reflecting the property sector crisis in China.

US

GDP growth for 3Q23 came in at 4.9%, well ahead of expectations and the prior quarter result, with consumer spending rising the most since 4Q21, led by housing and utilities.

Annual inflation was steady at 3.7% in September, slightly above market expectations of 3.6%, as a softer decline in energy prices offset slowing inflationary pressures in other categories.

The economy added 150,000 jobs in October, below the anticipated 180,000, with the unemployment rate rising to 3.9%. The labour market is slowly cooling as several strikes including from members of the United Auto Workers union weighed on manufacturing payrolls.

Consumers remain unsure about the economic outlook with confidence dropping to 63.8 in October. Retail sales in September increased 0.7%, well above the 0.3% forecast, with the annual rate increasing 3.75%.

The S&P Global Composite PMI rose to 50.7 in October, a marginal increase on the previous month despite fragile demand conditions.

The trade deficit widened to US$65.1 billion in September, above the forecast US$59.9 billion deficit.

Euro area

The European Central Bank maintained the main interest rate at 4.5% at its October meeting, pausing at a 22-year high following ten consecutive rate hikes since July 2022. GDP shrank by 0.1% in 3Q23 while annual inflation slowed to +2.9% for October, its lowest rate since mid-2021. This suggests that the ECB is almost certainly finished raising interest rates.

PPI fell to 0.5% in September, with the annual rate dropping by 12.4% as energy costs continued to fall.

Unemployment rose to 6.5% in September, above the market forecast of 6.4%.

Consumer confidence dropped to -17.9 in October, as the continued sticky inflation has eroded purchasing power.

Retail sales fell 0.3% in September, exceeding the market expectations of a 0.2% suggesting that consumer demand is continuing to face challenges due to high interest rates and sticky inflation.

The Composite PMI was lower at 46.5 in October , with a pronounced deterioration in the services sector.

UK

UK annual inflation remained at 6.7% in September, above the expected 6.6%, with core inflation dropping to 6.1%. Both these figures remain significantly above the Bank of England's 2% target, further complicating the task for policymakers who are expected to keep interest rates unchanged in November.

PPI fell to 0.1% in September, compared to market expectations of a 0.2% decline. Consumer confidence fell sharply to -30 in September as the high cost of living and economic uncertainty weighed on sentiment. Retail sales dropped 0.9% in September, against an anticipated 0.2% fall. Annual sales fell 1.0%, more than the expected -0.1%.

China

The Chinese economy expanded by 4.9% in 3Q23, beating market forecasts of 4.4% and offering hopes that it will meet the official annual target of around 5% this year, as sustained stimulus from Beijing offset the impact of a prolonged property crisis and weak trade.

Chinese manufacturing data for October was well below market expectations. Both the official government and private Caixin/S&P Global manufacturing purchasing managers’ indices fell below 50, returning to a contraction of activity. The Chinese government’s non- manufacturing PMI also fell in October, indicating a slowdown in the construction and broader services sectors.

The unemployment rate improved to 5.0% in September, the lowest figure for nearly two years.

Annual inflation remained unchanged at 0% in September, ahead of the anticipated 0.2%. Annual retail sales grew 5.5% in September, exceeding market estimates of 4.9%. This is the ninth consecutive month of increases and the highest in four months.

Japan

The Bank of Japan modified its yield curve control policy, but not as much as investors had expected. The central bank had maintained a 1.0% upper limit on the 10 year government bond yield since July, but has now withdrawn its pledge to defend that level with unlimited bond buying, which leaves it more as a loose reference point rather than a rigid cap. The annual inflation rate fell to 3.0% in September, below the market forecast of 3.1%. This is the lowest reading in a year and core inflation dropped to a 13 month low of 2.8%.

The unemployment rate fell to 2.6% in September and in line with market expectations.

The consumer confidence index rose to 35.7 in October, with sentiment increasing in most components. Retail sales fell 0.1% in September, with the annual rate rising 5.8%, just below the forecast 5.9%.

The composite PMI came 50.5 in October, While this represents the tenth month of expansion, it is the weakest reading.

Currencies

The Australian dollar (AUD) depreciated over the month of October, closing -1.5% lower in trade weighted terms to 60.2, depreciating against all four referenced currencies in this update.

The fluctuations in the AUD throughout the month were linked to various factors, including the distressing events in the Middle East, the US 10-year bond yields reaching their highest levels since 2007, adjustments in RBA interest rate hike predictions prompted by Q3 CPI data, and the S&P500 following the correction in Hong Kong and China stock markets.

Relative to the AUD, the Euro (EUR) led the pack in October, appreciating by 1.5%. Conversely, the Japanese Yen (JPY) was the laggard of the month, albeit appreciating in relative terms by 0.1% against the AUD. Year-on-year, the AUD remains behind the Pound Sterling (GBP), EUR and USD by -6.4%, -7.3% and -0.9% respectively, whilst ahead of the JPY by 1.0%.