Market Update - November 2022

Welcome to the November edition of the Market Update

Key Points

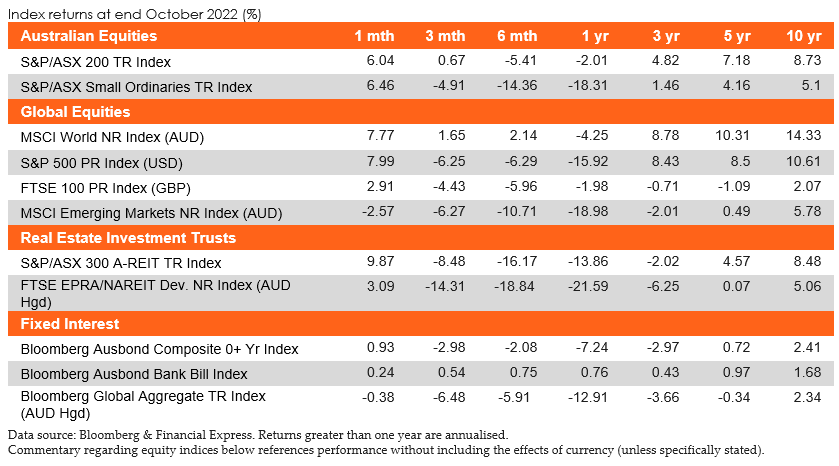

· Australia’s S&P/ASX 200 Index finished materially higher in October returning 6.0%. Most sectors of the market finished the month in positive territory.

· The US markets experienced material gains with the S&P 500 Index (USD) finishing the month higher by 8.1%. Likewise, European markets also had generous returns with the FTSE Eurotop 100 Index up 6.1%.

· In contrast to developed markets, Asia’s Hang Seng Index (HKD) experienced one of the steepest declines in world markets finishing down by -14.7%.

Australian equities

The Australian market finished October with the S&P/ASX 200 Accumulation Index rising sharply by +6.0%, with nine out of the eleven sectors finishing positively. The top performers were the Financials (+12.2%), Property (+9.9%) and Energy (+9.5%) sectors as the broader market rebounded from substantial selling pressure in September.

The Financials sector was led by strong performance amongst the major Australian banks, whilst the Property sector also rebounded from heavy year-to-date losses as investors continued to price in volatility around policy rate outlook. Likewise, Energy performed strongly as the tight supply conditions continued to place upward pressure on spot prices across various segments of the market.

Overall, geopolitical uncertainty abroad continued to persist, whilst major central banks indicated the prospect of further interest rate tightening to control persistently higher inflationary figures. In an Australian context, the CPI figures surprised to the upside with the Reserve Bank of Australia subsequently electing for an 0.25% increase in the cash rate.

In October, Momentum (+7.41%) and Value (+7.41%) paced all factors. Over the past quarter, Value (+2.95%) and Enhanced Value (+1.85%) have outperformed all other factors. Similarly, Momentum (+5.77%) and Value (+3.22%) have been the best performing factors over the past 12 months.

Global equities

Global equities saw respite in October as September’s developed market losses were mostly erased. A combination of resilient corporate earnings in the U.S., easing concerns of an energy crisis in Europe, and a mutual hope that Central Banks could be nearing a monetary policy pivot sent markets higher. The same could not be said for China and Hong Kong however with the Hang Seng finishing the month materially lower. Investors are concerned that Premier Xi Jinping’s historic third term will be dominated by a might to secure China’s economic independence and news that China will not relax its strict zero-COVID policy also weighed on sentiment. Chinese and Hong Kong markets are down -40.2% and -27% for the year, respectively.

Emerging Markets were therefore unable to participate in the same rally seen by developed market equities as China’s returns weighed heavily. Despite this, there were still several winners. Indonesia, Thailand, India, Malaysia, and South Africa outperformed the index. OPEC+’s production cuts assisted oil exporting markets to advance. The MSCI Emerging Markets Index (hedged to AUD) closed October -2.6% lower.

Property

October experienced a considerable turnaround in performance for both the local A-REIT market and the broader Global real estate equities market with the S&P/ASX 200 A-REIT Index (AUD) and the FTSE EPRA/NAREIT Developed Ex Australia Index (AUD Hedged) advancing 9.9% and 2.9% MoM, respectively. This was the second-best month for A-REIT returns since the December 2020 rally. Australian infrastructure performed well during October, with the S&P/ASX Infrastructure Index TR advancing 7.8% for the month, and 7.9% YTD.

October was quiet on the M&A front across the A-REIT sector. Growth Point Properties (ASX: GOZ) announced the sale of its Brisbane, Ann Street property for $141mn to the RAM Ann Street Diversified Property Nominees Pty Ltd. Settlement is expected to occur by the end of 2022, with Growthpoint planning to use the funds to pay off existing debt. This was Growthpoint’s only ‘true’ CBD asset, divesting away from this follows their focus on A-grade assets with high green credentials.

The Australian residential property market experienced a –1.1% change month on month in October represented by Core Logic’s five capital city aggregate. Brisbane (-1.9%), Sydney (-1.3%) and Melbourne (-0.9%) were the worst performers. Adelaide (-0.3%) and Perth (-0.2%) stayed relatively neutral.

Fixed Income

Australian fixed income markets were met with a reprieve in October. While the RBA has continued to tighten, in their October meeting they increased the cash rate by a smaller than expected 25bps. Yields on 2 and 10-year Australian Government Bonds both fell by approximately 25bps over the course of the month, which was the primary driver in the Bloomberg AusBond Composite 0+ Yr Index returning 0.93% during the course of October.

Internationally, markets continued to sell off as a hawkish Federal Reserve has given no indication of an end to rate rises in the US. The Bloomberg Global Aggregate Index (AUD Hedged) returned -0.38% in October, while the unhedged variant returned -0.14% due to currency fluctuations.

Key Points

· The IMF revised its global growth forecast for 2023 to 2.7%, 0.2 percentage points lower than the July forecast.

· The RBA raised interest rates by 25 bps in September, bringing the cash rate to 2.6%.

· The European Central Bank raised interest rates by 75bps, as it battles high inflation and a looming recession

Australia

In a bid to bring inflation under control, the RBA raised rates by a smaller than expected 25 bps in October, bringing the cash rate to 2.6%.

The unemployment rate was unchanged at 3.5% in September, matching market estimates. Retail sales rose 0.6% in September, bringing the annual rate to 17.9%

The Westpac-Melbourne Institute Index of Consumer Sentiment dropped to 83.7 in October, on the back of deteriorating households’ expectations over the economy in the next 12 months. This downcast view was matched by the NAB Business Survey which declined to 0 amid concerns over rising interest rates and a gloomy global outlook.

The S&P Global Composite PMI fell to 49.8 in October, with both demand and output declining.

The trade surplus increased to a three-month high of $12.44 billion in September, easily beating market forecasts of $8.85 billion, with exports jumping 7%.

Global

The IMF revised its global growth forecast for 2023 to 2.7%, 0.2 percentage points lower than the July forecast. The organisation forecasts this 2023 slowdown will be broad-based, with about one-third of global economies poised to contract over the next year. The United States, China, and the euro area will continue to stall and for many economies, 2023 will feel like a recession. The major points from the report are:

· The growth forecast for China lowered to 4.4% due to a weakening property sector and continued lockdowns.

· The tightening of monetary and financial conditions in the United States will slow growth to 1% next year.

· The slowdown is most pronounced in the euro area, where the energy crisis caused by the war in Ukraine will continue to take a heavy toll, reducing growth to 0.5% in 2023.

US

Inflation rose 0.4% in September, double the expected 0.2%, but the annual rate eased for the third straight month to 8.2%. Annual inflation remains well above the US Federal Reserve's target of 2%, suggesting policymakers will maintain their hawkish rhetoric and keep raising interest rates at a quick pace.

Non-farm payrolls came in at 261,000 for October, above the anticipated 210,000. The unemployment rate stood at 3.7% in October, 20bps above expectations and last month’s figure.

Consumer sentiment rose to 59.9 in October, just above the anticipated 59.8. Retail sales were flat in September, missing the forecast +0.2%, with the annual rate growing 8.2%.

The S&P Global Composite PMI declined to 47.3 in October, pointing to the second-fastest pace of contraction in the sector since 2009 with the exception of the initial pandemic period. PPI l rose 0.4% in September, above the forecast +0.2%, with the annual rate dropping to 8.5%, slightly above the forecast 8.4%.

The US trade gap widened to a three-month high of $73.3 billion in September, above market forecasts of $72.2 billion.

Europe

The European Central Bank raised interest rates by 75bps in October, as it battles high inflation and a looming recession. The central bank also expects to raise interest rates further in coming months if inflation remains persistently high.

The annual inflation rate in the Euro area jumped to 10.7 % in October, above the anticipated 10.2%, with energy prices having the biggest impact.

Consumer confidence rose by 1.2 points to -27.6 in October, which is in line with expectations. Retail sales rose 0.4% in September as widely expected. Annual retail sales fell 0.6% in September, well below the anticipated -1.3%.

Unemployment came in at 6.6% in September, in line with market estimates.

The S&P Global Composite PMI fell to 47.3 in October extending the downturn into a fourth straight month and pointing to the fastest decline in output since November 2020.

PPI rose 1.6% in September, slightly below forecasts, while the annual rate eased to 41.9% but still increased pressure on the ECB to continue its monetary policy tightening.

UK

Inflation rose 0.5% in September with the annual inflation rate rising to 10.1%. The Bank of England expects inflation to peak at 13% in 2023.

The unemployment rate fell to 3.5% in August, below the market forecast of 3.6%.

Consumer confidence rose to -47 in October as British households contend with the cost of living crisis and heightened political and economic uncertainty. Retail sales dropped 1.4% in September, bringing the annual rate to -6.9%. Both were down on market forecasts of -0.5% and -5.0% respectively.

The composite PMI index came in at 48.2 in October, with manufacturing production falling at a much faster pace than services activity.

PPI increased 0.20% in September with the annual rate rising 15.9%.

Liz Truss resigned as UK Prime Minister in late October, replaced by Rishi Sunak, a former Chancellor of the Exchequer.

China

China’s annual inflation rate fell to 2.1% in October, below market consensus and well within the government’s target range.

The unemployment rate rose to 5.5% in September, above the forecast of 5.2% due to a resurgence of COVID-19 in some cities.

The Caixin Manufacturing PMI came in at 48.3 in October as the Chinese economy faced increasing downward pressure and the negative impact of Covid controls.

Retail sales increased 0.4% in September, with the annual rate rising to 2.5%, below the market estimate of 3.3%, as consumption slowed due to the impact of strict COVID curbs in several big cities.

Balance of trade recorded a surplus of $85.15 billion in October, below expectations and after recording a surplus of $84.7 billion in September.

The IMF lowered its Chinese growth forecast for 2023 to 4.4%, on the basis of a weakening property sector and continued lockdowns.

Asia Region

During its October meeting, the Bank of Japan maintained its key short-term interest rate at -0.1% and that for 10-year bond yields around 0%. It lifted its inflation forecast to 2.9%, citing surging energy and food prices.

Inflation was unchanged at 0.3% month on month and 3.0% annually in September.

The unemployment rate rose to 2.6% in September, above the forecast 2.5%.

The consumer confidence index in Japan dropped to 29.9 in October, the lowest figure in over a year, amid surging prices and mounting global headwinds.

Retail Sales in Japan increased 1.1 % in September well about the expected 0.8%, with the annual rate rising 4.5%, exceeding the 4.1% market expectation. Overall household spending grew by 1.8% in September, broadly in line with consensus, with the annual rate increasing by 4.5%.

The Composite PMI increased to 51.7 in October, with services activity growing the most in four months following government actions to promote growth within the tourism sector.

Currencies

The Australian dollar closed with a marginal loss over the month of October, falling by -0.3% in trade-weighted terms to 61.3.

Primary drivers of volatility over the month were led by the unexpected interest rate policy announcement by the Reserve Bank of Australia, raising rates by 25 bps, only half of the anticipated rise. Abroad in the United Kingdom, the appointment of Rishi Sunak as prime minister and reversal of many previously controversial tax cuts led to a strengthening of the UK bond market and subsequent rally in Pound sterling (GBP). Worldwide risk sentiment continued to be widely influenced by the intensification of the conflict in Ukraine, rising inflation and global central bank monetary policy.

Relative to the AUD, the GBP led the pack in October, appreciating 2.8% against the dollar. Conversely the Japanese Yen (JPY) lagged over the month falling by -2.6% relative to the AUD. Year-on-year, the AUD is ahead of the JPY and GBP by 10.8% and 1.5% respectively, and behind the Euro (EUR) and US dollar (USD) by -0.6% and -14.9% respectively.

Disclaimer: This document is for the exclusive use of the person to whom it is provided by Lonsec and must not be used or relied upon by any other person. No representation, warranty or undertaking is given or made in relation to the accuracy or completeness of the information presented in this document, which is drawn from public information not verified by Lonsec. Financial conclusions, ratings and advice are reasonably held at the time of completion but subject to change without notice. Lonsec assumes no obligation to update this document following publication. Except for any liability which cannot be excluded, Lonsec, its directors, officers, employees and agents disclaim all liability for any error or inaccuracy in, misstatement or omission from, this document or any loss or damage suffered by the reader or any other person as a consequence of relying upon it. Copyright © 2022 Lonsec Research Pty Ltd (ABN 11 151 658 561, AFSL No. 421445) (Lonsec). This report is subject to copyright of Lonsec. Except for the temporary copy held in a computer's cache and a single permanent copy for your personal reference or other than as permitted under the Copyright Act 1968 (Cth), no part of this report may, in any form or by any means (electronic, mechanical, micro-copying, photocopying, recording or otherwise), be reproduced, stored or transmitted without the prior written permission of Lonsec. This report may also contain third party supplied material that is subject to copyright. Any such material is the intellectual property of that third party or its content providers. The same restrictions applying above to Lonsec copyrighted material, applies to such third party content.