Welcome to the June edition of the Market Update

Market Key Points

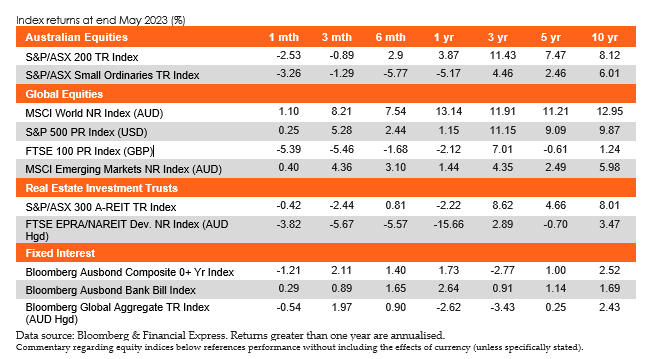

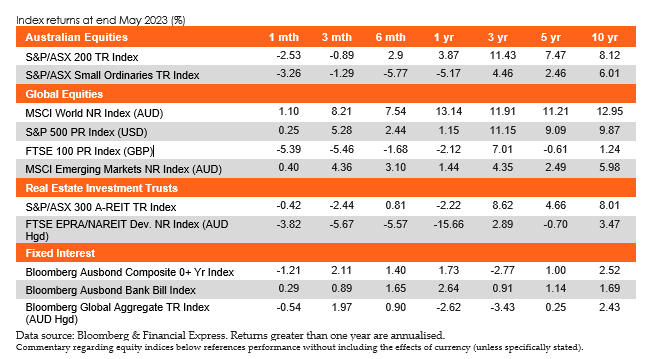

- The Australian equity market finished May down 2.5%. While strong returns in Information Technology were evident, most sectors of the market finished the month lower.

- With the exception of the US and Japan, most global markets finished May weaker. The S&P 500 (USD) returned 0.4%, while the Nikkei 225 Index (JPY) returned 7.0%).

- European markets were softer over the month, with FTSE 100 Index (GBP) (-4.9%), and FTSE Europtop 100 Index (EUR) (-2.0%). Chinese markets, as represented by the CSI 300 Index (CNY) finished the month 5.6% weaker.

Australian Equities

In May the S&P/ASX 200 Accumulation Index finished with a loss of 2.5%. Rising costs have begun to materialise for consumers as retail turnover plateaued, with another RBA hike and a fall in the iron ore price also impacting returns. Information Technology (I.T.) shares rose significantly (+11.6%), with Utilities making the only other meaningful jump (+1.1%). Consumer Discretionary (-6.1%) and Staples (-4.6%) were noteworthy laggards. Materials (-4.4%) and Financials ex-Property (-3.3%) also dragged on the Index. In total, 7 of the 11 sectors posted losses. I.T. advanced on the positive news from some of its names, while attention on the rise of artificial intelligence also aided gains.

Meanwhile, retail spending data led to investors positioning for a slowdown, as cost of living pressures saw consumers pull back on non-essential shopping. As doubts linger around the economic recovery in China, the sliding price of iron ore hampered Materials. Financials ex-Property were pushed down by poor US banking sentiment, as well as concerns about the domestic outlook for earnings and margins.

In May, all Factors performed negatively. Growth (-2.8%) and Momentum (-2.7%) were the worst performers. Over 12 months, Quality (+5.2%) and Value (+4.8%) have been the best performing Factors in the Index.

Global Equities

Global equities ended with a predominantly negative month with declining economic data. Emerging markets underperformed developed market counterparts returning 0.4% (MSCI Emerging Markets Index (AUD)) versus a 1.2% gain according to the MSCI World Ex Australia Index (AUD).

The U.S. markets had mixed results, with the debt ceiling debate being suspended on top of another expected rate hike. Lower unemployment and promising developments in the technology sector, particularly artificial intelligence and chipmakers, led a positive gain of 0.4% in the S&P500 Index (in local currency terms).

Equities across Asia were also mixed, Japanese stocks became more attractive for investors with sound earnings results with share buyback announcements for large cap stocks. The Nikkei 225 Index reached new highs with a gain of 7.0% for the month (in local currency terms). China’s economic growth recovery continued to perform beneath investors' expectations with demand also decreasing. This was reflected by the Hang Seng Index and the CSI 300 Index, returning -7.9% and -5.6% respectively (in local currency terms) for the month. Investors are waiting for stronger indications of an economic recovery in China, potentially led by the technology sector.

Property

The S&P/ASX 200 A-REIT Accumulation index regressed in May after a strong rally in April, with the index finishing the month –1.8% lower. Global real estate equities (represented by the FTSE EPRA/NAREIT Developed Ex Australia Index (AUD Hedged)) also regressed, returning -3.8% for the month. Australian infrastructure continued its positive momentum during May, with the S&P/ASX Infrastructure Index TR advancing +1.5% for the month.

May was relatively quiet across the A-REIT sector. Some activity includes Abacus Property Group (ASX:ABP) announcing their intentions to conduct a de-stapling, creating a new ASX-listed, Self-Storage REIT. The new REIT will be known as Abacus Storage King (ASX: ASK), with Abacus to remain listed on the ASX under a new ticker, ABG. Growth Point Properties (ASX: GOZ) completed an on market buy-back, acquiring over 19 million securities (2.5% of shares on issue) for a total consideration of $60.5 million.

The Australian residential property market experienced an increase by +1.4% Month on Month (as represented by CoreLogic’s five capital city aggregate). Sydney was the biggest riser (+1.8%) alongside Brisbane (+1.4%) also performing strongly. All five capital cities performed positively in the month for the first time in over two years.

Fixed Income

Credit markets saw a decline as interest rates rose again in May when the Reserve Bank of Australia increased the official cash rate from 3.60% to 3.85%, leading to a -1.21% return of the Bloomberg AusBond Composite 0+ Yr Index. Over the course of the month, spreads widened as Australian 2Y and 10Y Bond yields rose by 50bps and 27bps, respectively. Persistent inflation pressures along with a strong labour market and rising wages have the potential to keep inflation rates above the RBA target for an extended period.

Global markets were taken aback in early March by the unexpected failure of three small- to mid- size US banks, followed by the collapse of Credit Suisse. The effects from the March turmoil continue to affect markets with the Bloomberg Barclays Global Aggregate Index (AUD hedged) returning -0.54% over May. In a decision widely expected by markets, the U.S Federal Reserve again increased rates by 25bps bringing the federal funds rate to a target of 5.0%-5.25%. Bond yields continued to grow with US 2Y and 10Y Treasury Note yields rising 45bps and 22bps, respectively.

Economic key points

- Services inflation, rent rises and wage pressures however persist, meaning inflation could remain sticky and above central bank target ranges for some time.

- RBS increased the cash rate to 3.85%

- Both the Fed and ECB increased interest rates by 25 bps to 5.25% and 3.75% respectively.

Australia

The RBA increased the cash rate by 25bps to 3.85% at its May meeting. The board agreed further increases may still be required, depending on how the economy and inflation evolve. The Westpac-Melbourne Institute Index of Consumer Sentiment for May fell to 79.0, from 85.8 in April, with consumers showing deep pessimism after a surprise interest rate hike and mildly disappointing federal budget. A large number of home borrowers will roll off ultra-low fixed rate home loans onto significantly higher mortgage rates in the coming months, further dampening consumer confidence.

GDP grew 0.2% over the three months to 31 March 2023, down from 0.5% in the previous quarter and below the expected 0.3 % increase.

The inflation rate rose to 6.8% in April, driven by energy prices, with the underlying rate easing to 6.5%.

April’s unemployment rate increased to 3.7%, above the market expectation of 3.5%. Retail sales were flat as well, below market expectations of a 0.3% rise as consumers spent less on discretionary goods in response to cost-of-living pressures and rising interest rates.

Composite PMI fell to 51.6 in May, with services expanding at a slower pace than previous months. The NAB business confidence index rose 1 point to 0 in April, still below the average, with confidence still negative in retail, wholesale, and finance, business & property.

The trade surplus decreased to $11.2 billion in April, below the market forecasts of $14 billion with the main driver a fall in total exports to China of 15.4%.

Global

Inflation is likely to ease substantially in the coming months as base effects roll off and tighter credit conditions hit consumption and aggregate demand. However, services inflation, rent rises and wage pressures persist, meaning inflation could remain sticky and above central bank target ranges for some time. Financial conditions are likely to remain tight as central banks keep a foot on the brake while managing pockets of stress via targeted liquidity support.

Consumer confidence remains weak globally and with the cash buffers built up during the pandemic largely eroded, signs that economic growth has begun to slow have emerged.

US

The Federal Reserve increased the cash rate by 25bps to 5.25% in its May meeting with officials expressing uncertainty about how much more policy tightening may be appropriate in the future.

Inflation rose 0.4% in April, matching market expectations, with the annual rate falling to 4.9%.

Non-farm payrolls unexpectedly added 339,000 jobs in May, way above the forecast 190,000 jobs. The unemployment rate rose to 3.7% in May, above the market expectation of 3.5%. Consumer confidence fell to 102.3 in May, down from an upwardly revised 103.7 in April. Retail sales in April increased 0.4%, well below the expected 0.8% with the annual rate increasing 1.6%. The S&P Global Composite PMI rose to 54.3 in May on the back of increased activity in the services sector.

The trade deficit widened to a six month high of US$74.6billion in April, compared to the expected US$75.2 billion.

Euro Zone

With inflation remaining well above the target level, the European Central Bank raised the key interest rate by 25 bps to 3.75%. The latest announcement slows the pace of rate hikes after the ECB had raised the key interest rate by 0.5% at its previous three opportunities. The annual inflation rate fell to 6.1% in May, below the expected 6.3%, largely driven by the 1.7% decrease in energy prices. Unemployment was flat at 6.5% in April, meeting market expectations.

Consumer confidence increased slightly to -17.4 in May. Retail sales for April came in flat, against expectations of 0.2% The annual rate was also down 2.6%, above the anticipated -3.0%.

The Composite PMI dropped to 52.8 in May. Services activity continued to grow, albeit at a slower rate, while manufacturing production declined at the sharpest pace since November due to rapidly deteriorating order books. PPI dropped 3.2% in April, slightly below the expected -3.1%, with the annual rate dropping to 1%, below the predicted 1.4%.

Persistent inflation has helped push Germany into recession, with the economy contracting 0.3% in the first three months of the year, following the 0.5% contraction in the last three months of last year. The recession is likely to be not as long or deep as some predicted with the German central bank forecasting modest growth in Q2 2023.

UK

The Bank of England increased interest rates by 25bps to 4.5% in May as it continues to battle high inflation. Inflation rose 1.2% in April, bringing the annual rate to 8.7% which is below the 10% mark for the first time in eight months. The central bank now sees inflation falling to 5.1% in Q4 2023, compared to 3.9% in the February forecast and to meet its 2% target by late 2024.

The unemployment rate for March came in at 3.9% against expectations of 3.8% and following a prior reading of 3.8%.

Consumer confidence rose to -27 in May, matching expectations. Annual retail sales fell 3.0%, above the anticipated 2.8%fall.

The composite PMI index fell to 54 in May, with divergence between the services and manufacturing sectors continuing as the expansion for service providers (55.2 vs 55.9 in April) offset the decline for goods producers (47.1 vs 47.8)

PPI was flat month on month in April, with the annual rate easing sharply to 5.4%, mainly due to the further decline in prices of petroleum products.

China

Inflation declined 0.2% in May and rose 0.2% year on year, highlighting Beijing's challenge to stimulate enough economic activity and growth to kill the threat of deflation.

The unemployment rate declined to a 16 month low of 5.2% in April, below the government target of 5.5%. In response to the record high unemployment rate of 16-24 year of 20.4%, the government has adopted an ‘employment- first strategy’ with the hopes of adding 12 million new jobs this year.

Annual retail sales for April increased by 18.4%, missing market forecasts of 21.0% but sharply accelerating from the 10.6% gain in March.

Composite PMI rose to 55.6 in May, the fifth straight month of growth in private sector activity and the steepest pace since December 2020.

India overtook China as the world’s most populous country in April. India’s population is virtually certain to continue to grow for several decades. By contrast, China’s population reached its peak size recently and experienced a decline during 2022.

Japan

Japan's GDP expanded an annualised 2.7% in January-March, much higher than a preliminary estimate of a 1.6% growth and economists' median forecast for a 1.9% rise. This expansion was spurred by a post pandemic pick up in domestic spending and company restocking and helped offset the decrease in exports due to slowing global demand.

Inflation increased 0.6% month on month with the annual rate rising to 3.5% in April.

The unemployment rate fell to 2.6% in April, below the expected 2.7%.

The consumer confidence index in rose to 36 in May, slightly below the forecast 36.1, as household sentiment strengthened across most of the indices. Retail sales fell 1.20% in April, with the annual rate rising 5%, missing the market forecast of 7%. Despite missing forecasts, it was the 14th consecutive month of expansion as the country continues to recover from the pandemic slump.

The composite PMI increased to 54.3 in May, with service sector expanded at a record pace for the second straight month, while manufacturing production returned to growth for the first time in 11 months.

Currencies

The Australian dollar (AUD) closed out the month of May with no change in trade weighted terms, holding at 59.8.

May saw a return to more 'normal' trading ranges with the AUD/USD pair marginally breaching the 10-year average of 3.5 cents. Volatility throughout the month was primarily led by the unexpected interest rate hike of 0.25% by the RBA, in addition to weaker than expected Purchasing Managers Index (PMI) survey data released in China.

Relative to the AUD, the US dollar (USD) led the pack in May, appreciating by 2.3%. Conversely, the Euro (EUR) was the laggard of the month, falling by 1.2% relative to the AUD. Year-on-year, the AUD remains behind the USD, EUR, Pound Sterling (GBP) and Japanese Yen (JPY) by -10.1%, -9.3%, -8.4% and -2.2% respectively and is down by -4.5% in trade weighted terms.

Disclaimer: This document is for the exclusive use of the person to whom it is provided by Lonsec and must not be used or relied upon by any other person. No representation, warranty or undertaking is given or made in relation to the accuracy or completeness of the information presented in this document, which is drawn from public information not verified by Lonsec. Financial conclusions, ratings and advice are reasonably held at the time of completion but subject to change without notice. Lonsec assumes no obligation to update this document following publication. Except for any liability which cannot be excluded, Lonsec, its directors, officers, employees and agents disclaim all liability for any error or inaccuracy in, misstatement or omission from, this document or any loss or damage suffered by the reader or any other person as a consequence of relying upon it. Copyright © 2023 Lonsec Research Pty Ltd (ABN 11 151 658 561, AFSL No. 421445) (Lonsec). This report is subject to copyright of Lonsec. Except for the temporary copy held in a computer's cache and a single permanent copy for your personal reference or other than as permitted under the Copyright Act 1968 (Cth), no part of this report may, in any form or by any means (electronic, mechanical, micro-copying, photocopying, recording or otherwise), be reproduced, stored or transmitted without the prior written permission of Lonsec. This report may also contain third party supplied material that is subject to copyright. Any such material is the intellectual property of that third party or its content providers. The same restrictions applying above to Lonsec copyrighted material, applies to such third party content.