Market Update - January 2023

Welcome to the January edition of the Market Update

Key Points

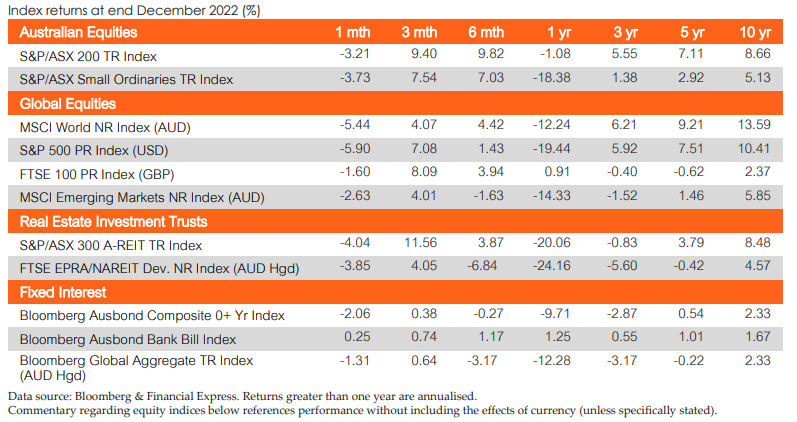

- Australia’s S&P/ASX 200 Index finished the month lower by -3.2%, with all sectors of the market finishing the month in negative territory.

- The US markets experienced a pickup in volatility with the S&P 500 Index (USD) finishing the month lower by -5.8%. Likewise, European markets also had declines with the FTSE Eurotop 100 Index (EUR) lower by -3.9%.

- Asian and emerging markets fared better with the Hang Seng Index (HKD) generating a strong return of 6.4% and the CSI 300 Index (CNY) finishing up by 0.6%.

Australian equities

The Australian market concluded the year with the S&P/ASX 200 Accumulation Index falling by -3.2% and every sector finishing negatively. The Materials (-0.9%) and Utilities (-1.2%) led all sectors, as the broader market ‘Santa Rally’ faded in December and investors evaluated potential global macroeconomic uncertainty moving forward into 2023.

The Consumer Discretionary (-7.0%) and Information Technology (-5.4%) sectors were the biggest laggards as the prospect of further hawkishness from global central banks weighed on investors. The Materials sector was the most robust performer as commodities were relatively steady amidst China reopening optimism and higher gold spot prices. Despite the broader market selloff, volatility was relatively muted as Australian investors repositioned themselves for 2023 after a strong month in November. In 2022, Energy (+49.0%) and Utilities (+30.0%) were the strongest performers, whilst Information Technology (-33.7%) and Property (-20.5%) were the biggest fallers. Overall, the broader market decline ultimately meant that the Australian market finished the year with a decrease of -1.1%.

In December, the Dividend Opportunities factor (-1.0%) was the top performer. Over the past quarter, Enhanced Value (+10.6%) and Value (+10.2%) outperformed all other factors. Similarly, Enhanced Value (+5.8%) and Value (+5.6%) were the best year-to-date performers.

Global equities

Global equities ended 2022 with a monthly decline across most major indices. Emerging markets continued their relative strength against their developed market counterparts, recording a -2.6% loss according to the MSCI Emerging Markets Index (AUD) versus a -5.5% loss according to the MSCI World Ex Australia Index (AUD). MSCI World Ex Australia Index (AUD) closed 2022 down -12.5%, and MSCI Emerging Markets Index (AUD) down -14.3%.

Across key global regions, there were few safe havens for investors to park their money, as the war in Ukraine, disordered supply chains, rampant inflation, and another year of Covid turned markets on their head. China’s CSI 300 Index had approximately one-fifth (- 19.8%) of its valued wiped in 2022, followed closely by the S&P 500 index (-18.1%).

Property

Local and Global REITs sold off during December following two positive months. Domestically, the AREITs index (represented by the S&P/ASX 200 A-REIT Accumulation Index) ended the month -4.1% lower. The index has returned –20.5% on a total return basis YTD to 31 December. Global REITs outperformed the local REITs index, albeit still experiencing a drawdown of – 3.8% during the month. Domestically, infrastructure (represented by the S&P/ASX Infrastructure Index) has followed the trend in A-REITs, returning –1.44% in December bringing YTD performance down to 18.5%.

December was relatively quiet across the A-REITs sector. Some activity includes Dexus (ASX: DXS) announcing the sale of six properties with combined proceeds of $483mn, two of which were trading properties. Centuria Industrial REIT (ASX: CIP) announced the settlement of a 50% interest in a portfolio of eight existing CIP assets for $180.9mn to an investment vehicle sponsored by Morgan Stanley Real Estate Investing.

The Australian residential property market experienced a –1.2% change month on month in December represented by Core Logic’s five capital city aggregate. Brisbane (-1.4%), Sydney (-1.4%), and Melbourne (-1.2%) were the worst performers. Perth (+0.2%) was the only city within the five to advance. The %YoY change for Core Logic’s five capital city aggregate as of 31 December 2022 is –7.1%.

Fixed Income

In its final meeting of the year, the Reserve Bank has again raised interest rates by 25bps bringing the target cash rate to 3.1%. Australian 2- and 10- year Government bond yields rose this month by 35bps and 52bps, respectively. The rise in bond yields resulted in almost every fixed income sector being in the red, resulting in the Bloomberg AusBond Composite 0+ Yr Index to return -2.06% over the course of the month. The Australian unemployment rate however remains steady, supporting the growth outlook of the economy.

Globally, fixed income markets show a similar story, with US 10-year Bond yields up 27bps while US 90 Day T-Bill Yields remained relatively steady. On their December 14 meeting, The Federal Reserve raised the target federal funds rate to 4.25%-4.50%, with a rate hike of 50bps.

Key points

- China abandoned its zero Covid policy in response to widespread protests.

- The RBA raised rates by 25bps, bringing the cash rate to 3.1%.

- The Federal Reserve raised rates by 50 bps to 4.5%.

Australia

With inflation remaining persistently high, the RBA raised rates by 25bps in December, bringing the cash rate to 3.1%. The Board added inflation would peak around 8% in 2022 before easing in 2023 and reaching around 3% in 2024. The headline CPI for November was 7.3%, up from 6.9% in October, with housing, food and transport costs being major contributors to this rise.

The unemployment rate was unchanged at 3.4% in November, matching market estimates. The wage price index increased 3.1% year on year in Q3, amid improved business conditions. Retail sales grew 1.4% in November, well above the expected 0.6% rise, as shoppers took advantage of heaving discounting in Black Friday sales. This, along with the high CPI figure, points to a further rate rise when the RBA next meets in early February.

The Westpac-Melbourne Institute Index of Consumer Sentiment for December increased 3% to 80, with expectations that the interest rate tightening cycle was nearing an end. However, this reading is still in contractionary levels as households continue to grapple with high inflation. Composite PMI fell to 47.5 in December, led by a decline in the services sector and the first decrease in manufacturing output in 11 months.

The trade surplus widened to $13.2 billion in November, ahead of market forecasts of $10.5 billion.

Global

December was a month of surprises with China abandoning most of its Covid-zero strategy and the Bank of Japan its 10-year yield target in a move that will allow long-term rates to rise more. Russia’s war in Ukraine continued to fuel increased global food prices and uncertainty around energy supply, especially European gas storage for next winter. The desire for energy security at a local level is seeing the accelerated adoption of renewable energy sources and the war may be the turning point in the history of energy generation.

US

The Federal Reserve raised interest rates by 50 bps to 4.5%, with interest rates expected to reach 5.1% in 2023.

Inflation slowed for a sixth straight month to 6.5% in December, in line with estimates. Despite the continued slowdown, inflation is set to remain more than three times the Fed's 2% target into 2023.

Non-farm payrolls added 222,000 new jobs in December, ahead of expectations of 200,000, whilst the unemployment rate was lower than expected at 3.5%. Consumer confidence rose sharply to 108.3 in December, ahead of expectations. Retail sales declined 0.6% month-on-month in November, well behind the expected 0.1% fall, with the annual rate growing 6.5%.

The S&P Global Composite PMI dropped to 45.0 in December indicating a strong decline in both manufacturing and services output. PPI l rose 0.3% in November, ahead of the anticipated 0.2%, with the annual rate easing to 7.4%, the lowest since May 2021.

The US trade deficit narrowed to $61.5 billion in November, against the forecast $73 billion.

Europe

The ECB raised interest rates by 50 bps to 2.5% at its December meeting, marking the fourth increase for the year. The Bank also flagged further rate rises due to the substantial upward revision in the inflation outlook, with average inflation expected to be 8.4% in 2022, 6.3% in 2023 and 3.4% in 2024.

The annual inflation rate in the Euro area dropped to 9.2% in December, below the expected 9.7%. Energy prices eased but food, alcohol and tabaco prices continued to rise.

Consumer confidence rose for a third consecutive month to -22.2 in December, showing improved consumer expectations of household finances and the economy more generally. Retail sales rose 0.8% in November, ahead of the expected 0.5% increase, while the annual rate dropped 2.8%. November’s unemployment rate was flat at 6.5% and in line with expectations.

The Composite PMI came in at 49.3 in December, a five month high. However, business sentiment remains historically subdued, reflecting company concerns about the energy market outlook, high inflation and the rising risk of recession.

PPI dropped 0.9% in November, matching market expectations, with the annual rate easing further to 27.1%, below the expected 27.5%.

UK

In a majority decision, the Bank of England raised interest rates 50pbs to 3.5% in December as policymakers try to contain inflation and manage the likelihood of a recession in 2023.

Inflation eased to 10.7% in November, slightly below the 10.9% market forecast. The BOE believes inflation has peaked and expects it to fall rapidly from mid-2023.

Consumer confidence rose to -42 in December but remains muted as high inflation continues to erode household income and the country braces for a prolonged recession. Retail sales unexpectedly fell 0.4% in November, bringing the annual rate to -5.9%, slightly below the forecast -5.6%. This is the eighth consecutive fall as the impact of the cost-of-living crisis hits many households.

The composite PMI index rose to 49 in December, up from 48.2 in November and in line with estimates.

China

Covid infections remain a key driver in China as the government abandoned key parts of its zero-Covid strategy in mid-December following protests in major cities. Infections remain high with the resulting labour shortages affecting economic activity, particularly in the manufacturing sector.

Inflation fell to 0.2% in November, with the annual rate falling to 1.6%, mainly due to a sharp slowdown in the cost of food.

The unemployment rate rose to a six month high of 5.7% in November amid ongoing Covid restrictions. With restrictions now eased, this is expected to drop in December.

Composite PMI rose to 48.3 in December, with factory activity dropping the most in three months due to a spike in Covid infections. With China playing a pivotal role in global supply chains, Covid infections affecting the country’s industrial base will have ongoing international ramifications.

Retail sales rose 0.15% in November, with the annual rate dropping 5.9%, worse that than the expected -3.7%, as consumption deteriorated on the back of a new wave of COVID infections and ongoing restrictions.

China's trade surplus widened to $78.01 billion in November, ahead of the market estimates of $76.2 billion.

Asia region

In a surprise decision, the Bank of Japan widened the band around its 10-year yield target -a move that will allow long-term rates to rise more - while keeping its key interest rate steady at -0.1%. The BOJ also sees inflation slowing below its target of 2% in 2023 as the effects of high import costs fade.

Inflation increased 0.3% month on month and 3.8% annually in November, the highest reading in 30 years, amid high prices of imported raw commodities and a weak yen.

The unemployment rate fell to 2.5% in November, in line with forecasts. Wage growth is expected to increase gradually due to intensifying labour shortages and structural changes in Japan's job market, which are leading to higher pay for temporary workers and a rise in the number of permanent workers.

The consumer confidence index in Japan reversed its downward trend, rising to 30.3 in December amid waning Covid disruptions

Retail Sales in Japan dropped 1.1% in November, well below the market forecast of a 0.4% rise, % with the annual rate rising 2.6%, also falling behind the expected 3.7% gain.

The Composite PMI rose to 49.7 in December, with a boost to the services sector as tourists began to return to the country. This was partially offset by subdued demand and intense cost pressures in the manufacturing sector.

Currencies

The Australian dollar (AUD) fell over the final month of 2022, closing -1.1% lower in trade-weighted terms to 61.4.

Volatility over the month was primarily influenced by an unexpected announcement from the Bank of Japan (BoJ), hastened pace in the reopening of the Chinese economy and sustained tightening of monetary policy amongst global central banks. The BoJ's surprise announcement concerning their revised yield curve control policy, sent ripples through bond and equity markets alike as investors grappled with the unpredictability of the Japanese central bank.

Relative to the AUD, the Japanese Yen (JPY) led the pack in December, appreciating 4.5%. Conversely the US dollar (USD) was the monthly laggard falling by - 1.5% relative to the AUD. Year-on-year, the AUD remains ahead of the JPY and Pound Sterling (GBP) by 6.8% and 4.9% respectively, but now modestly trails the Euro (EUR) by -0.4% in addition to the USD at -6.2%.

Disclaimer: This document is for the exclusive use of the person to whom it is provided by Lonsec and must not be used or relied upon by any other person. No representation, warranty or undertaking is given or made in relation to the accuracy or completeness of the information presented in this document, which is drawn from public information not verified by Lonsec. Financial conclusions, ratings and advice are reasonably held at the time of completion but subject to change without notice. Lonsec assumes no obligation to update this document following publication. Except for any liability which cannot be excluded, Lonsec, its directors, officers, employees and agents disclaim all liability for any error or inaccuracy in, misstatement or omission from, this document or any loss or damage suffered by the reader or any other person as a consequence of relying upon it. Copyright © 2023 Lonsec Research Pty Ltd (ABN 11 151 658 561, AFSL No. 421445) (Lonsec). This report is subject to copyright of Lonsec. Except for the temporary copy held in a computer's cache and a single permanent copy for your personal reference or other than as permitted under the Copyright Act 1968 (Cth), no part of this report may, in any form or by any means (electronic, mechanical, micro-copying, photocopying, recording or otherwise), be reproduced, stored or transmitted without the prior written permission of Lonsec. This report may also contain third party supplied material that is subject to copyright. Any such material is the intellectual property of that third party or its content providers. The same restrictions applying above to Lonsec copyrighted material, applies to such third-party content.