Market Update - December 2022

Welcome to the December edition of the Market Update

Australian equities

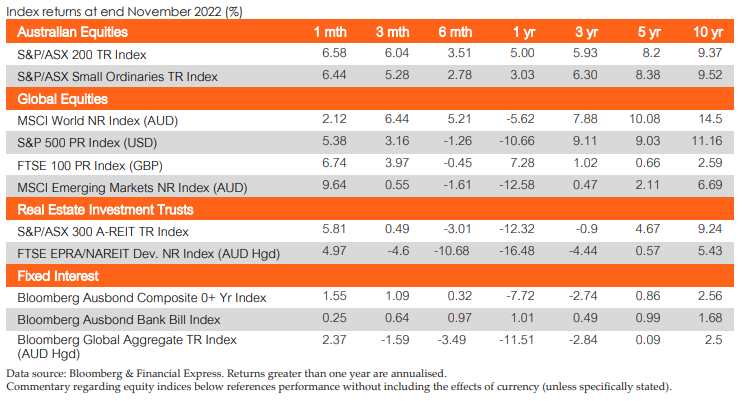

The Australian market rounded out November with the S&P/ASX 200 Accumulation Index rising by +6.6% with every sector finishing positively. The Utilities (+20.9%) and Materials (+16.3%) sectors as the broader market continued its rally from the intensive selling pressure that was experienced in previous months.

The Materials sector was buoyed by speculation around China’s potential exit from the ‘Zero-COVID’ policy. In turn, this resulted in a substantial increase in the spot price of iron ore and other commodities which resulted in strong performance within the Materials sector. Meanwhile, the strong Utilities sector performance was primarily driven by the outperformance from several large names within the sector. Furthermore, volatility subsided amidst optimism around the potential policy rate and inflationary outlook moving forward both domestically and globally. The positive performance was primarily driven by comments from the US Federal Reserve around monetary policy, which was ultimately well-received by global equity markets.

In November, Dividend Opportunities (+9.9%) and Growth (+7.8%) were the top performers. Over the past quarter, Value (+13.3%) and Equal Weight (+13.0%) have outperformed all other factors. Similarly, Value (+8.6%) and Enhanced Value (+7.8%) have been the best year-todate performers.

Global equities

Global equities continued their momentum through November, chipping away at losses from what has been a turbulent year. Emerging market equities outperformed their developed market counterparts, posting a 9.6% gain according to the MSCI Emerging Markets Index (AUD). MSCI World Ex Australia Index (AUD) heads into the final month of the year down - 7.0%, year-to-date (YTD) and MSCI Emerging Markets Index (AUD) -12.0% YTD.

Across key global regions, common themes contributed to the risk-on sentiment. Cooling inflation and robust employment data out of the US, better than expected economic growth out of the UK, reduced energy dependence due to warmer autumn conditions in the Eurozone and loosening of COVID-19 restrictions in China helped domestic markets advance. The Hang Seng was the best performing broad-based index for the month of November, returning a stellar 26.8%. Japan’s Nikkei 225 Index was relatively muted, returning 1.4%.

Property

The S&P/ASX 200 A-REIT Accumulation index advanced strongly during November, returning the first consecutive positive month since March of this year, with the index finishing the month 5.8% higher. Global real estate equities (represented by the FTSE EPRA/NAREIT Developed Ex Australia Index (AUD Hedged)) also finished strongly, advancing 5.1% for the month. Australian infrastructure performed well during November, with the S&P/ASX Infrastructure Index TR advancing 11.4% for the month and 20.2% YTD.

November was relatively quiet across the A-REITs sector. Some activity includes Dexus (ASX: DXS) disposing of their St Leonards property for a price of $118.5mn. Cromwell Property Group (ASX: CMW) announced the sale of its Wollongong Asset, in line with their aim to dispose of non-core assets, for an agreed price of $53mn (represents a 3.9% premium to book value). Ingenia Communities Group (ASX: INA) announced the acquisition of development projects in Sunbury, Melbourne, and Gordonvale, Cairns for $9mn and $19.5mn respectively. These two projects combined provide INA with 23.1 hectares of development opportunities.

The Australian residential property market experienced a –1.1% change month on month in October represented by Core Logic’s five capital city aggregate. Brisbane (- 1.8%), Sydney (-1.3%), and Melbourne (-0.8%) were the worst performers. Adelaide (-0.3%) and Perth (0%) stayed relatively neutral.

Fixed Income

Government bond yields continued to fall in November as the RBA continued its battle with high inflation. On their November 1 meeting, the Board increased the cash rate target by another 25bps, bringing the total to 2.85%. Global factors as well as strong domestic demand explain much of the current CPI inflation rate, which over the year to September sits at 7.3%. Australian 2- and 10- year Government Bond yields fell by 12bps and 23bps relatively, while Australian 90 Day Bank Bills remained steady over the course of the month. The Bloomberg AusBond Composite 0+ Yr Index delivered another positive month, returning 1.6%.

Globally, quantitative tightening persisted, as rates continued to rise. The US Federal Reserve raised rates by another 75bps, bringing the federal funds target rate to 3.75%-4.00%. US 10 Year Bond yields fell 44bps while yields on US 90 Day T-Bills rose 26bps.

Economic News

Australia

With inflation remaining persistently high, the RBA raised rates by 25bps in November, bringing the cash rate to 2.85%. This is the highest rate since April 2013, with the RBA raising their inflation expectations to 8% for 2022. The headline CPI for October was 6.9%, slowing from the 7.3% in September, and well below the market expectations of 7.4%.

GDP grew 0.6% in Q3, bringing the annual rate to 5.9% as the economy recovers from last year’s COVD- related lockdowns. The RBA forecasts annual GDP to average 4% for 2022 before easing to 2% in 2023 and 1.5% in 2024.

The unemployment rate edged down to 3.4% in October, against and expected rise of 3.6%. The labour market remains tight, with a further fall in unemployment likely in the coming months. Retail sales fell 0.2% in October, missing the market forecast of +0.5%, amid cost of living pressures and rising interest rates, but the annual rate increased 12.5% in October.

The Westpac-Melbourne Institute Index of Consumer Sentiment dropped to 6.9% to 78 in November, as rising interest rates and surging inflation continue to weigh on household finances and the economy. Composite PMI fell to 48 in November, with the services sector being the main drag. The trade surplus narrowed to $12.22 billion in October, ahead of market forecasts of $12.1 billion.

Global

The OECD updated its economic outlook this month, with global GDP predicted to slow to 2.2% in 2023 in the face of persistently high inflation and massive energy price shock. The major points of the report are:

• Increasing energy prices are taking a heavy toll, with Europe at risk of energy shortages over the next two winters

• Growth in the USA and Europe has sharply slowed, and the major Asian emerging-market economies are expected to account for close to three-quarters of global GDP growth in 2023.

• Inflation will remain high in 2023 but tighter monetary policy and decelerating growth will help to moderate inflation

US

The Federal Reserve raised interest rates by 0.75 points to 4% at the beginning of November as inflation shows little sign of abating.

Inflation rose 0.4% in October, below the forecast 0.6%, but the annual rate eased for the fourth month in a row to 7.7%%. Despite inflation coming in below expectations, there remains strong inflationary pressures and a broad price increase across the economy. GDP came in at 2.9% growth in 3Q22, above expectations and the prior quarter result whilst the annual rate came in at 1.7%.

Non-farm payrolls added 263,000 new jobs in November, against expectations of 200,000 whilst the unemployment rate remained steady at 3.7% in November. Consumer confidence came in at 100.2 in November, ahead of expectations and falling from 102.5 in October. Retail sales surged 1.3% month-over-month in October beating market forecasts of +1%, with the annual rate growing 8.3%.

The S&P Global Composite PMI dropped to 46.3 in November from 48.2 in the previous month, signalling the sharpest pace of contraction in the private sector since August. PPI l rose 0.2% in October, below the anticipated 0.4%, with the annual rate dropping to 8.0%, below the forecast 8.3%.

The US trade deficit widened further to $78.2 billion in October, against the market forecast of $80 billion.

Europe

The annual inflation rate in the Euro area eased to 10% in November. This is the first time that inflation has eased since June, it remains at 5 times the target European Central Bank target rate, with the bank believing inflation has yet to peak.

Consumer confidence rose 3.6 points to -23.9 in November, showing improved consumer expectations about the general economic situation. Retail sales fell by 1.8% in October after expanding by 0.8% in the prior month, while the annual rate dropped 2.7%. Unemployment fell to 6.5% in October, slightly below the expected 6.6%.

The Composite PMI came in at 47.8 for November after 47.3 in the prior month, month.

PPI dropped 2.9% in October, compared to market expectations of a 2.0% fall, with the annual rate slowing sharply to 30.8%. Despite this easing, inflationary pressures across Europe remains high amid a weakening economic outlook and a deepening energy crisis, suggesting a need for continued monetary tightening.

UK

The Bank of England raised interest rates by 75pbs to 3% in November, on the back of concerns about stubbornly high inflation and a weakening economic outlook. It also projects GDP to continue its fall throughout 2023 and 2024 H1, as high energy prices and tighter financial conditions weigh on spending.

Inflation jumped to 11.1% in October, the highest level in 41 years, with energy prices showing little sign of nearing a peak.

The unemployment rate rose slightly to 3.6% in September, above the market forecast of 3.5%. Consumer confidence rose to -44 in November as political concerns eased following the appointment of Rishi Sunak as Prime Minister.

Retail sales increased 0.6% in October, double the market forecast of a 0.3% rise. This brings the annual rate to -6.1%, better than the forecast -6.5%.

The composite PMI index came in at 48.3 in November, marginally up on the October figure of 48.2. PPI increased 0.90% in October, with the annual rate coming in at 14.8%.

China

The Chinese unemployment rate was unchanged at 5.5% in October, which was in line with market forecasts.

Composite PMI fell to 47 in November as the country braced for a third wave of COVID infections and shutdowns. This PMI decline was broad-based, with factory activity shrinking for the fourth month in a row and the services sector contracting the most in six months. With China playing a pivotal role in global supply chains, lockdowns affecting the country’s industrial base will have major international consequences.

Retail sales decreased 0.7% in October, due to the impact of rising COVID infections and strict restrictions. In the same period, annual retail sales fell 0.5%, well below the market forecast of a 1% rise. China's trade surplus declined to $69.84 billion in November, far below market forecasts of a surplus of $78.1 billion, due to weakening global demand.

Asia region

The Japanese government maintained its view that the economy is recovering moderately, as solid pent-up demand for services following the lifting of COVID-19 curbs continued to support private consumption despite accelerating inflation in November.

GDP came in -0.2% lower for Q3, bringing the annual rate to -0.8%.

Inflation was increased 0.6% month on month and 3.7% annually in October, the highest reading since January 1991, amid high prices of imported raw commodities and persistent weakness of the yen. The unemployment rate was unchanged at2.6% in October, above the forecast 2.5%.

The consumer confidence index in Japan continued its downward trend, coming in at 28.6 in November, on the back of rising prices and global headwinds.

Retail Sales in Japan increased 0.2% in October, below the market forecast of 0.7% with the annual rate rising 4.3%, less than the 5.0% market expectation. Overall household spending grew by 1.1% in October, below the expected 1.5%, with the annual rate rising 1.2%.

The Composite PMI dropped to 48.9 in November, with sharp drops in output and new orders in the manufacturing sector.

Currencies

The Australian dollar (AUD) gained ground over the month of November, closing 1.3% higher in tradeweighted terms to 62.1.

Volatility over the month was primarily driven by central bank interest rate policy posture. Whilst rate rises are still prevalent across the globe, market sentiment has shifted around the estimated quantum of rate hikes in the near future toward a more 'normal' level. In addition, the AUD was supported through relative weakening of the US dollar (USD) as rumours related to the loosening of China's zero COVID policies evolved into reality coupled with announced support for China's property sector. The softening of the USD was further exacerbated by weaker than expected US CPI data.

Relative to the AUD, the Japanese Yen (JPY) led the pack in November, appreciating 1.6%. Conversely the US dollar (USD) lagged over the month falling by 4.9% relative to the AUD. Year-on-year, the AUD is ahead of the JPY, Pound Sterling (GBP) and Euro (EUR) by 16.4%, 4.9% and 3.6% respectively, but remains behind the USD by -5.5%.

Disclaimer: This document is for the exclusive use of the person to whom it is provided by Lonsec and must not be used or relied upon by any other person. No representation, warranty or undertaking is given or made in relation to the accuracy or completeness of the information presented in this document, which is drawn from public information not verified by Lonsec. Financial conclusions, ratings and advice are reasonably held at the time of completion but subject to change without notice. Lonsec assumes no obligation to update this document following publication. Except for any liability which cannot be excluded, Lonsec, its directors, officers, employees and agents disclaim all liability for any error or inaccuracy in, misstatement or omission from, this document or any loss or damage suffered by the reader or any other person as a consequence of relying upon it. Copyright © 2022 Lonsec Research Pty Ltd (ABN 11 151 658 561, AFSL No. 421445) (Lonsec). This report is subject to copyright of Lonsec. Except for the temporary copy held in a computer's cache and a single permanent copy for your personal reference or other than as permitted under the Copyright Act 1968 (Cth), no part of this report may, in any form or by any means (electronic, mechanical, micro-copying, photocopying, recording or otherwise), be reproduced, stored or transmitted without the prior written permission of Lonsec. This report may also contain third party supplied material that is subject to copyright. Any such material is the intellectual property of that third party or its content providers. The same restrictions applying above to Lonsec copyrighted material, applies to such third party content.