Market Update - August 2022

Welcome to the August edition of the Market Update

Australian equities

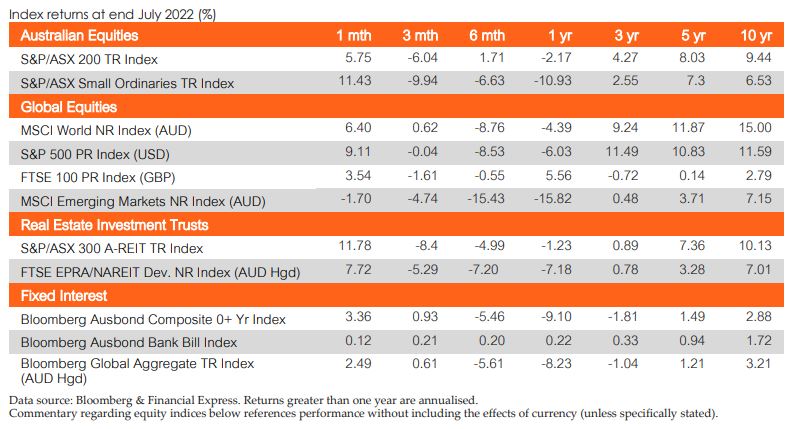

The Australian share market finished July with the S&P/ASX 200 rebounding sharply by 5.75% and ten out of eleven sectors finishing higher. The Information Technology (+15.23%) and Property (+11.93%) sectors led the rebound for the month. Meanwhile, the only negative finisher for the month was the Materials (-0.67%) sector.

Throughout the month, market participants continued to evaluate worldwide central bank monetary policy and the release of economic data as the broader market enjoyed a ‘relief rally’. In particular, sectors with long duration exposure rebounded after months of strong selling pressure in the midst of rising interest rates and inflationary pressures. As a result, the Information Technology and Property sector rallied as investors rotated into previously out of favour sectors with large year-to-date losses. In contrast, the Materials sector was a noteworthy underperformer as worldwide recessionary fears continued to intensify given the continuing geopolitical and macroeconomic uncertainty.

In July, all factors finished positively, with Equal Weight (+10.82%) and Momentum (+7.24%) being the strongest performers. Enhanced Value (+7.22%) and Value (+1.13%) were the only positive year-to-date performers. Over the past twelve months, these same factors were the best performers, gaining 10.05% and 6.20% respectively.

Global equities

Worldwide risk assets saw a positive return for the first time since December last year over the month of July, albeit with recession fears evolving into reality in the US. Developed markets steeply increased by 6.4%, with Global small caps outperforming their large cap counterparts producing an 8.0% return by month end. Emerging and Asian markets did not fare as well as their Developed market peers, returning -1.7% and -0.6% respectively.

As economic data continues to indicate a slowing global economy and inflation rises persist, July's respite was primarily driven by markets pricing in potential interest rate cuts by central banks in 2023. Quality and Growth factors were the best performers over the month returning 7.8% and 7.4% respectively, whilst Dividend Yield and Value were the laggards returning 2.2% and 2.1% respectively according to MSCI ACWI Single Factor Indices reported in local currency terms.

Property

July experienced a considerable turnaround in performance for both the local A-REIT market and the broader Global real estate equities market with the S&P/ASX 200 A-REIT Index (AUD) and the FTSE EPRA/NAREIT Developed Ex Australia Index (AUD Hedged) advancing 11.9% and 7.7% MoM, respectively.

Globally REITs have been bolstered by a strong second quarter earnings season and investors having largely priced in the effects of the Fed’s monetary policy. Australian infrastructure performed well during July, with the S&P/ASX Infrastructure Index TR advancing 1.2% for the month, and 14.4% YTD.

M&A activity during March across the A-Reit Sector saw Charter Hall Retail REIT (ASX: CQR) acquire 18 service stations in New Zealand and further expand their partnership with Ampol Ltd, acquiring 5% interest in an existing Charter Hall partnership which owns 204 Ampol service stations. The combined value of the acquisitions is $101.7mn and will be funded from existing investment capacity. Additionally, Growth Point Properties (ASX: GOZ) announced they will be acquiring 100% of Fortius Funds Management for a value of $45mn. This transaction adds $1.9bn third party funds to Growthpoint increasing their total assets under management to $7.2bn.

The Australian residential property market experienced a –1.4% change month on month represented by Core Logic’s five capital city aggregate. Sydney (-2.2%), Melbourne (-1.5%) and Brisbane (-0.9%) were the worst performers. Adelaide continues to show strength (+0.4%) moving to +24% YoY with Perth (+0.2%) staying relatively neutral.

Fixed income

Building inflation concerns, recession fears and interest rate hikes have dominated and influenced global fixed income markets throughout July. The 10-year global bond yields declined sharply in July due to softening economic data. A broad relief rally in global bonds reversed some of the YTD underperformance. Australian 2 Year Bonds remained relatively stable, rising by only 7bps, while Australian 10 Year Bonds steadily dropped by 60bps throughout the month. With the decline in bond yields and narrowing of credit spreads, the Bloomberg Ausbond Composite Index gained 3.36% in July.

Globally, the story is much the same as markets increase expectations for future Federal Reserve rate hikes. Inflation in the US has now accelerated to 9.1%, the highest since 1981. Following the 26-27 July meeting, the Federal Reserve increased interest rates by 75bps, bringing the annual rate to 2.25%. Over the course of July, US 90 Day T- Bills rose by 69bps while US 10 Year Bonds dropped 37bps. July provided some relief to global bonds, with the Bloomberg Barclays Global Aggregate Index (AUD hedged) returning 2.49% during the month. Persistent inflation pressures, supply chain problems and tightening monetary policy will continue affecting local and global fixed income markets for some time.

Economic News

Australia

The RBA raised rates by 50 bps in July, bringing the cash rate to 1.355% in a bid to bring inflation down and to create a more sustainable demand and supply. Inflation rose 1.8% in June, bringing the annual rate to 5.1%. The unemployment rate remained at 3.5% in June, well below the expected 3.8%. Retail sales increased by 0.2% in June, with the annual rate rising to 12%.

The Westpac-Melbourne Institute Index of Consumer Sentiment fell 3% in July, down for the eighth month in a row amid surging prices and the prospect of more tightening by the RBA. The NAB Business Survey for May dropped 5 points to a below average 1, dragged down by global uncertainty, looming interest rate hikes and soaring inflation.

The S&P Global Composite PMI fell to 51.1 in July, with, manufacturing hampered by weather conditions, delayed construction projects, and supply chain difficulties.

The trade surplus widened to a new record high of $17.67 billion in June, easily beating market forecasts of a $14billion surplus, amid solid global demand and surging commodity prices.

Global

Global Covid-19 surpassed 572 million cases and 12.3 billion vaccine doses administered as at the end of July. Rising inflation and interest rates continue to dominate in most major economies with the inflation rate in the UK rising to a 9.4. The IMF revised down its 2022 growth forecast to 3.2%, 0.4% lower than in April this year. It also believes that disinflationary monetary policy is expected to bite in 2023, with global output growing by just 2.9 percent.

The US Federal Reserve raised rates by 0.75% in July, taking the borrowing rate up to a range of 2.25%-2.5%. This is the fourth consecutive rate rise as the Fed seeks to tamp down runaway inflation without creating a recession. Inflation rose 1.3% in June, above the expected increase of 1.1%, with the annual rate rising to 9.1%, as energy prices rose 41.6%.

Non-farm payrolls added 528,000 jobs in July, well ahead of the market forecast 250,000, with the biggest gains in the leisure and hospitality sector. The unemployment rate in July dropped to 3.5%. Personal incomes grew 0.6% in June, which is above the 0.5% forecast.

Consumer sentiment rose to 51.5 in July, above the forecast 49.9, as concerns over global factors have eased. Retail sales grew 1% in June, beating forecasts of 0.8%, with the annual rate growing 8.4%.

The S&P Global Composite PMI fell to 47.7 in July, signalling the first contraction in private sector business activity since June 2020. PPI jumped 1.1% in June, above the forecasted 0.8%, with the annual rate accelerating 11.3%%.

The trade deficit narrowed by US$5.3 billion to a six-month low of US$79.6 billion in June. This compares to the market forecast of US $80.1 billion.

The European Central Bank raised interest rate by 50bps to 0.5% during its July 2022 meeting, the first increase since 2011, in an attempt to release the inflationary pressures.

The annual inflation rate in the Euro area rose to a new high of 8.9% in July, above the anticipated 8.6 as prices continued to accelerate for food, alcohol & tobacco.

Consumer confidence fell to -27 in July which is in line with expectations. Retail sales dropped 1.2% in June, the biggest decline so far this year and much worse than market forecasts of a flat reading. Annual retail sales fell 3.7%, well below market expectations of -1.7%, as high consumer prices, borrowing costs and low confidence weigh on consumer spending.

Unemployment was unchanged at 6.6% in June and in line with market forecasts. The S&P Global Composite PMI fell to 49.9 in July as manufacturing shrank for the first time in two years and services activity slowed sharply.

PPI rose 1.1% in June, while the annual rate fell to 35.8%, slightly above market expectations of 35.7%.

In the UK, inflation rose 0.8% in June, above the 0.7% expected, with the annual inflation rate rising to 9.4%. The biggest price pressure came from the cost of motor fuels which increased at a record 42.3%, as average petrol prices rose by 18.1 pence per litre.

The unemployment rate held at 3.8% in May, below the expected 3.9%. Consumer confidence was steady at -41 in July as runaway inflation and economic uncertainties continued to dampen sentiment. Retail sales fell 0.1% in June, compared to the expected 0.3% fall, with the annual rate coming in at 5.8%.

The PMI composite index fell to 52.1 in July and signalled the slowest rate of expansion since February 2021. PPI dropped 1.4% in June with the annual rate to rising 16.5%.

The Chinese economy shrank by 2.6% in the three months to June, compared to market estimates of a 1.5% contraction, in part due to the lockdowns imposed in major Chinese cities from March to May, including the financial and commerce hub of Shanghai. The annual rate rose 2.5% in June above the expected 2.4%.

The Caixin Composite PMI jumped to 55.3 in June, amid the improving COVID-19 situation and implementation of a package of measures to support economic recovery. The Manufacturing PMI climbed to 51.7 in June from 48.1 in May, topping market forecasts of 50.1. Annual industrial production unexpectedly grew by 0.7% in May, easily beating the market consensus of a 0.7%.

The unemployment rate fell to 5.5% in June, amid continued efforts by the government to revive the momentum of economic recovery by further easing of COVID-curbs.

The Caixin Composite PMI fell to 54 in July with services activity rising faster amid a marked slowdown in manufacturing expansion. The Manufacturing PMI declined to 50.4% in July from, missing market forecasts of 51.5. This reflected the recent widespread COVID lockdowns and electricity shortages at some firms. Annual industrial production grew 3.9% in June, below the market consensus of 4.1%, but much faster than the 0.7% gain in May.

Annual retail sales unexpectedly rose by 3.1% in June, easily beating market estimates of a flat reading as consumption recovered following a drop in COVID-19 cases.

As widely expected, the Bank of Japan left its key short-term interest rate unchanged at -0.1% and that for 10-year bond yields around 0% during its July meeting. The Bank cut its 2022 GDP growth forecast to 2.4% from the 2.9% made in April, citing a slowdown in overseas economies and persistent supply chain issues due to the prolonged war in Ukraine.

Japan’s annual inflation rate came in at 2.4% in June, marking the tenth month in row of increases amid surging fuel and food costs and a sharply weakening yen. In the same month, the unemployment rate was 2.6%, above the anticipated 2.5%.

Japanese consumer confidence dropped to 30.2 in July amid rising COVID-19 cases and ongoing global uncertainty.

Retail sales decreased 1.4 % in June, with the annual rate rising 1.5%, missing the market consensus of 2.8%.

The Composite PMI dropped to 50.2 in July, marking the softest growth in private sector activity. Business sentiment softened, amid concerns of muted economic conditions and inflation uncertainty, the weaker yen, and the Ukraine war.

The country was shocked by the assassination of former Prime Minister Shinzo Abe on July 8, as he delivered a campaign speech in Nara.

Currencies

The Australian Dollar closed the month of July higher than it started, posting gains across most of its major currency pairs. In trade-weighted terms, the Australian Dollar gained 2.1% to 63.1.

In Europe, growing fears of a recession, induced by soaring gas prices, meant the Euro had further to slide. The Australian Dollar is now 6.84% stronger against its European counterpart since Russia’s invasion of Ukraine in February 2022.

In the US, speculation of a reduction in future interest rate rises saw the Australia Dollar rally. The US Federal Reserve has warned the world’s largest economy is now slowing.

The Bank of Japan’s yield-control policy continues with inflation running at 2.4% on year, locally. The Japanese Yen remains at its weakest level in 20 years.

Alternatives

Preliminary estimates for July indicate that the index decreased by 8.5 per cent (on a monthly average basis) in SDR terms, after decreasing by 2.8 per cent in June (revised). The rural, non-rural and base metals sub-indices all decreased in the month. In Australian dollar terms, the index decreased by 7.6 per cent in July.

Over the past year, the index has increased by 14.1 per cent in SDR terms, led by higher LNG, coking coal and thermal coal prices. The index has increased by 14.4 per cent in Australian dollar terms.

Disclaimer: This document is for the exclusive use of the person to whom it is provided by Lonsec and must not be used or relied upon by any other person. No representation, warranty or undertaking is given or made in relation to the accuracy or completeness of the information presented in this document, which is drawn from public information not verified by Lonsec. Financial conclusions, ratings and advice are reasonably held at the time of completion but subject to change without notice. Lonsec assumes no obligation to update this document following publication. Except for any liability which cannot be excluded, Lonsec, its directors, officers, employees and agents disclaim all liability for any error or inaccuracy in, misstatement or omission from, this document or any loss or damage suffered by the reader or any other person as a consequence of relying upon it. Copyright © 2022 Lonsec Research Pty Ltd (ABN 11 151 658 561, AFSL No. 421445) (Lonsec). This report is subject to copyright of Lonsec. Except for the temporary copy held in a computer's cache and a single permanent copy for your personal reference or other than as permitted under the Copyright Act 1968 (Cth), no part of this report may, in any form or by any means (electronic, mechanical, micro-copying, photocopying, recording or otherwise), be reproduced, stored or transmitted without the prior written permission of Lonsec. This report may also contain third party supplied material that is subject to copyright. Any such material is the intellectual property of that third party or its content providers. The same restrictions applying above to Lonsec copyrighted material, applies to such third party content.