Market update - Coronavirus

The coronavirus is dominating the news and causing havoc on the share markets around the world. Many people may be tired of reading, and hearing about it. So apologies for sharing my two pence.

The coronavirus is dominating the news and causing havoc on the share markets around the world. Many people may be tired of reading, and hearing about it. So apologies for sharing my two pence.

Stock markets have endured greater corrections in the past and recovered as they will again.

We need to be patient, and retain our long term investment perspective.

After a strong year for returns in 2019 – particularly following a phase one trade agreement between the US and China after a prolonged period of uncertainty – markets have taken a considerable hit, highlighting flaws in and further weakening many regions around the world.

Looking ahead, there could be more volatility for equities as adjustments are made to supply chains to mitigate disruption and as macroeconomic influences on markets take time to stabilise. However, as the number of new cases falls over time, as governments work to slow the spread of the virus, and as restrictions are slowly lifted in China, confidence should slowly return to share markets.

What we know as at today

83,105 confirmed cases (+939, a 1.1% increase since yesterday); 2,858 deaths (+58; a 2.1% increase since yesterday); 8,472 cases (19%) deemed “critical”; 35,250 (81% of infected with “mild condition”; 32,812 recovered (+3,713; a 11.3% increase since yesterday).

- Quantity of new cases are reducing

- Quantity of people recovered increasing

- If you believe some of the statistics, China is gaining control

- China- 330 new cases, 78,825 total, with 43 additional deaths (2,788 total)

- Central and local governments are loosening criteria for factories to resume activities

- Starbucks has reopened 85% of the stores in China

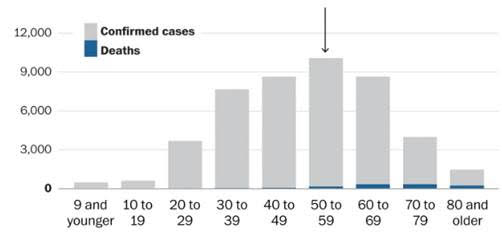

- Confirmed cases by age as per below

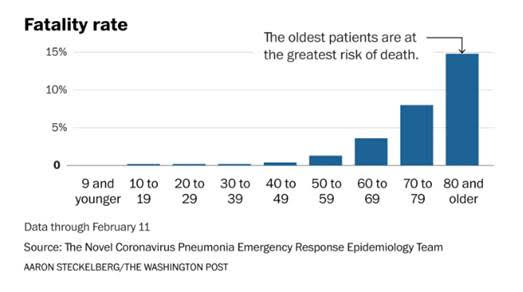

- Fatality rate

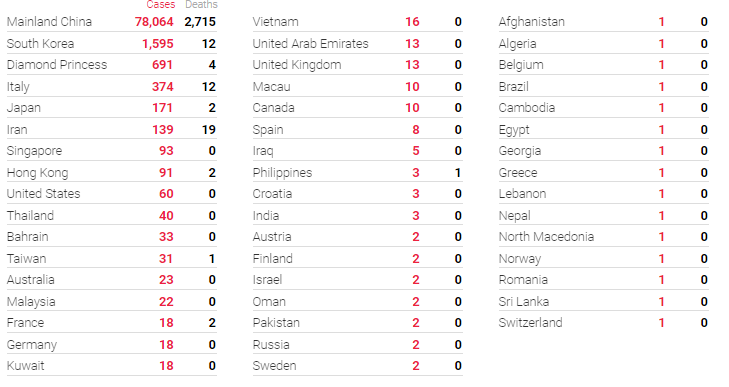

Outside China – 4,280 confirmed cases (+613, a 17% increase since yesterday); 52 countries and territories around the world; 70 deaths (+14, 35%, 2 HK; 1 Philippines; 8 Japan (includes Diamond Princess); 1 Taiwan; 2 France; 26 Iran; 13 South Korea; 17 Italy)

- South Korea has the highest number of new cases 505

- Italy had another 185 diagnosed patients

- The prevalence of people contracting pneumonia is high, can hospitals cope with the strain?

- WHO says we at a decisive point "the outbreak could go in any direction based on how we handle it"

- IMF said it is likely to downgrade global growth outlook

- In Australia the Prime Minister has activated an emergency plan to deal with the escalating outbreak

- Of Australia’s 23 cases, 8 were Diamond Princess cruise ship passengers

- US has 60 cases, 45 were repatriated from Wuhan or the Diamond Princess.

- Shenzhen China to ban the consumption of cats and dogs.

- Hong Kong government announced every adult over 18 years of age would receive $1,300 USD cash

- Stock markets had almost a delayed reaction to this outbreak. This has allowed many fund managers to rebalance their portfolios, reducing risk and protecting from the carnage of this week.

- Oil is down more than 10%, hopefully this flows through to the petrol bowsers

- Our investments in bonds, fixed interest and gold have increased in value

- The AUD has decreased in value, supporting our internationally owned assets

The questions we now face:

- Can further outbreaks be contained?

- How quickly can we return to normal?

- How will governments and central banks support citizens and businesses?

If you would like to discuss anything please contact us on 07 5528 0998.

Jeff Noble